how to calculate sales tax in oklahoma

The total sales tax rate in any given location can be broken down into state county city and special district rates. The jurisdiction breakdown shows the different sales tax rates making up the combined rate.

How To Calculate Sales Tax For Your Online Store

SalesTaxHandbook visitors qualify for a free month by.

. TaxFormFinder has an additional 54 Oklahoma income tax forms that you may need plus all federal income tax forms. Disclaimer and Terms Please read the terms and conditions for a description of the data included and the disclaimer of liability. It has the third highest average effective tax rate of Oklahomas 77 counties as it currently stands at 106.

Combined with the state sales tax the highest sales tax rate in Kansas is 115 in the cities of. Based on applicable tax laws eBay will calculate collect and remit sales tax on behalf of sellers for items shipped to customers in the following states and territories. This means that depending on your location within Ohio the total tax you pay can be significantly higher than the 575 state sales tax.

Municipal governments in New York are also allowed to collect a local-option sales tax that ranges from 3 to 4875 across the state with an average local tax of 4254 for a total of 8254 when combined with the state sales tax. I need sales tax rates for every state not just one. The combined tax rate is the total sales tax rate of the jurisdiction for the address you submitted.

You can print other Oklahoma tax forms here. Click here for a larger sales tax map or here for a sales tax table. For other South Carolina sales tax exemption certificates go here.

While most taxable products are subject to the combined sales tax rate some items are taxed differently at state and local levels. Your employees W-4 forms. Oklahoma County is the most populous county in the state and it contains the state capital Oklahoma City.

This certificate provides an exemption to purchasers when they are working together with a governmental agency. With so many jurisdictions generating rates rules and boundaries figuring out your sales tax rate is best accomplished with a street address rather than a city name a street name or a ZIP code. Click here for a larger sales tax map or here for a sales tax table.

Oklahoma Tax Commission - opens in new window or tab. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. How to use sales tax exemption certificates in Michigan.

It can calculate the gross price based on the net price and the tax rate or work the other way around as a reverse sales tax calculatorThe sales tax system in the United States is somewhat complicated as the rate is different depending on the state and. To calculate withholding tax youll need the following information. Or to make things even easier input the Los Angeles minimum combined sales tax rate into the calculator at the top of the page along with the total sale amount to get all the detail.

This means that someone in the state of Idaho who sells school supplies would be required to charge sales tax but an individual who sells medication might not be required to charge sales tax. To calculate the amount of sales tax to charge in Los Angeles use this simple formula. New York has a statewide sales tax rate of 4 which has been in place since 1965.

We offer a combined package at a discount if you need data for every state. This online sales tax calculator solves multiple problems around the tax imposed on the sale of goods and services. If youre reaching out because you are exempt from paying US sales tax please contact us through the Sales tax exemption option instead.

This table shows the total sales tax rates for all cities and towns in Orange. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. The maximum local tax rate allowed by New York law is.

The total sales tax rate in any given location can be broken down into state county city and special district rates. An example of an exemption to the states sales tax is certain prescription medications. These related forms may also be needed with the Oklahoma Form 511.

The IRS income tax withholding tables and tax calculator for the current year. California has a 6 sales tax and Orange County collects an additional 025 so the minimum sales tax rate in Orange County is 625 not including any city or special district taxes. Several examples of exceptions to this tax are certain groceries some medical devices certain prescription medications and machinery and chemicals that are used in development and research.

Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. Alabama has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 7There are a total of 372 local tax jurisdictions across the state collecting an average local tax of 5092. You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code.

Combined with the state sales tax the highest sales tax rate in New Mexico is. Use our free sales tax calculator above to return a sales tax. This means that an individual in the state of Texas purchases school supplies and books for their children would be required to pay sales tax but an individual who purchases school supplies to resell them would not be required to charge sales.

Kansas has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 4There are a total of 530 local tax jurisdictions across the state collecting an average local tax of 199. In the state of Georgia sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Taxpayer Identification Number.

An example of items that are exempt from Texas sales tax are items specifically purchased for resale. New Mexico has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 7125There are a total of 138 local tax jurisdictions across the state collecting an average local tax of 2283. Illinois has a 625 sales tax and Cook County collects an additional 175 so the minimum sales tax rate in Cook County is 8 not including any city or special district taxes.

Ohio has a 575 statewide sales tax rate but also has 578 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1505 on top of the state tax. Related Oklahoma Individual Income Tax Forms. If youre in one of these states you may be charged sales tax on your Etsy orderWe are required by your states laws to charge this tax.

Each employees gross pay for the pay period. Small business owners should learn how to calculate withholding taxes to make sure employees are being taxed at the. Sales tax total amount of sale x sales tax rate in this case 95.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Many US states recently started collecting sales tax on online purchases. Just choose All US.

Are services subject to sales tax in Idaho. The certificate contains a list of exemptions on its face including tangible personal property that is sold to the Federal Government. This table shows the total sales tax rates for all cities and towns in Cook County.

Oklahoma first adopted a general state sales tax in 1933 and since that time the rate has risen to 45 percent. States Sales Tax Database from the state selection dropdown. Click here for a larger sales tax map or here for a sales tax table.

If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state. For other Oklahoma sales tax exemption certificates go here. Combined with the state sales tax the highest sales tax rate in Alabama is 125 in the city of.

Oklahoma Income Tax Calculator Smartasset

Etsy Marketplace Collects Sales Tax For You Accounting For Jewelers

How To Charge Your Customers The Correct Sales Tax Rates

How Do State And Local Property Taxes Work Tax Policy Center

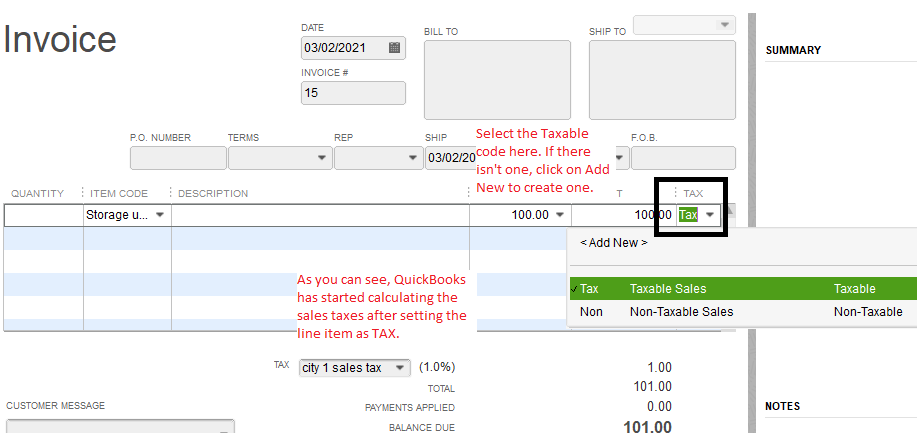

Solved How Do You Add Tax To Estimates And Invoices

How To Calculate Sales Tax On A New Car In Texas

Sales Tax Calculator And Rate Lookup Tool Avalara

Changing Corporate Income Tax Calculation Won T Create Jobs Maryland Center On Economic Policy

Sales Tax Guide For Online Courses

Oklahoma Sales Tax Calculator And Local Rates 2021 Wise

Oklahoma Tax Commission We Re Going Backtothebasics With Okcars Okcars Is A Convenient Online Resource Used Anywhere Anytime To Quickly Renew Vehicle Registration Order Specialty License Plates And Calculate New Vehicle Sales

Historical Oklahoma Tax Policy Information Ballotpedia

When Will Your City Feel The Fiscal Impact Of Covid 19

State Says Income Tax Exemption For Tribal Citizens On Reservations Inapplicable Despite Existing Law

What S The Car Sales Tax In Each State Find The Best Car Price

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities